It took me more than a week, but here is my report for last Tuesday's meetings. They were a particularly difficult set of meetings for me.

What Was Up?

COUNCIL WORK MEETING

1:00 PM, Tuesday, June 21, City Conference Room, 351 West Center

- A presentation from Envision Utah entitled "Your Utah, Your Future."

Report Only.

The main point of the presentation is that "centered" communities are more livable, cost less to service, and a vast majority of Utahns want to live is such communities. I support a smart approach to growth, and agree with these principles, but have to acknowledge that the questions in the surveys were written in a way to lead to the answers they were looking for.

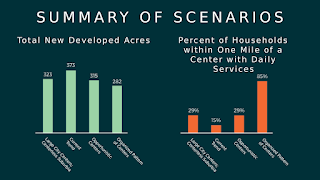

It costs 20% less to create infrastructure for "Centered" communities. Their vision of "Centered" communities still calls for 65% of new housing to be single family residential.

The graph on the right really drives home the benefit of "Centered" communities. 85% of our households could live within a mile of a center which provides daily-type services. To illustrate why this is important, consider the impact of Days Market in Northeast Provo vs. the impact of not having a grocery store in West Provo. Smart growth can help provide convenient access to amenities for all of our residents. The graph on the left shows that we can preserve open space and save developable land for future generations.

This is the graph I struggle with the most. Of the Provoans surveyed, 81% said that they want to live in communities designed for walking, transit, short drives, and housing variety. Not surprisingly, few wanted to live in the other scenarios described with phrases like "long driving distances". I personally think that centered-community principles will help us to grow smart, but I think this question was very leading and the loop-sidedness of the results are in part attributable to that.

- A discussion on an ordinance amending Provo City Code Chapter 2.01 (Form of Government) to define when a City Officer is unavailable under the Utah Emergency Interim Succession Act. (16-069)

This item needs further discussion.

See the last "What's Up?" for my description of this item. The Mayor suggested that two hours is probably too short of a time to become impatient and empower an interim mayor (who would only function until the elected mayor became available). I think that most of the Council feels that 48 hours (the current period) is too long. We are kicking this back to committee to find the sweet spot between 2 and 48.

- A discussion on the creation of a Council Audit Committee. (16-077)

Approved to set-up the Budget and Audit Committee 7:0

The Budget Committee is already familiar with the Budget so there is some synergy in asking them to also review the findings of the independent audit of City finances at the end of the year.

- A discussion and review of the Cost of Service Study for the Energy Department. (16-075)

Travis Ball will bring this item back to a Council Meeting next Fall after discussing with the Energy Board.

The main takeaway was that our current rates were not quite sufficient to cover the costs to provide power, but that they planned rate adjustments (which we began implementation later that night) will keep us balanced in the medium term. The structure of the rate increases also will help reduce the "interclass subsidization" (commercial and industrial users paying more than it costs to service them so that residents can pay less than it costs to service us). The last part of the discussion focused on distributed generation (i.e. roof top residential). Much of the cost of providing electrical service is independent of the volume of electricity used, but much of the revenue is derived from the number of KWH used. This is fine when most users have nearly the same "load factor", but some users (most importantly roof-top solar customers) cost about the same to serve (they want their light bulb to go on regardless of whether the sun is shining) but will substantially reduce the number of KWH they use. I support a rate structure which balances simplicity with the principle that everyone should pay their fair share. If we want to create incentives or hardship breaks, it should be done outside of the rate structure.

- A discussion on the fifth amended Interlocal Cooperative Agreement for the Ice Sheet Authority. (16-080).

Council Member George Stewart moved this item to the July 5, 2016 Council Meeting.

(Meaning that this item was moved forward to the next Council Meeting where it can be voted on). This mostly is an update to incorporate new State regulations on interlocal agreements. It also recognizes the current way the facility is being managed. This is not expected to affect the operation of the Ice Sheet.

- A discussion on updating the explanatory text for the 2016 Council Priorities. (16-015)

Moved to July 5, 2016 Work Meeting.

(Meaning that it was continued to then next Work Meeting) Some Councilors wanted more time to review the proposed changes.

- A follow-up discussion on the Fiscal Year 2016-2017 Budget. (16-054)

Motion to bring the ordinance without the tax increase to the Council Meeting tonight. Approved 4:3. Council Members Gary Winterton, David Sewell and David Harding opposed.

Five days before, towards the end of our day-long budget retreat, the Council voted to reaffirm and refine our Budget Intent Statement to hold truth-in-taxation meeting each year to consider adjusting the Property Tax Rate to compensate for inflation. We even selected the local index which would be used as the baseline. Now five days later, which this vote, the Council signaled that they would not carry out this budget intent. I feel that this Intent Statement is good fiscal policy and was disappointed that we are unwilling to follow it. I imagine I'll talk more about this when I address the budget vote in the later meeting.

- Provo City Community Development Department requests an amendment to Section 14.34.300 of the Provo City Code to clarify restrictions on farm animals adjacent to Residential Zones. City-Wide Impact. (16-0006OA)

Bill Peperone will bring this item back to the Council when he has addressed the questions.

This proposal has received some critical feedback as it has made it's way through the approval process. It will be brought back after some provisions are tweaked and clarified.

- Provo City Community Development Department requests amendments to the following code sections 15.17.030, 15.17.040, 2.29.040 and 14.02.020. The proposed amendments relate to reducing the notice for public hearing before the Planning Commission for General Plan adoption and for General Plan amendments from 14 to 10 days, as per Utah State Code, and to allow amendments to the General Plan more often than twice per year. City-Wide Impact. (16-0007OA)

Continue to the July 5, 2016 Work Meeting.

We were running out of time, so this was pushed off to the next Work Meeting.

- Closed Meeting

A closed meeting was held.

***

PROVO MUNICIPAL COUNCIL

Redevelopment Agency of Provo

Regular Meeting Agenda

5:30 PM, Tuesday, June 21, 2016

Room 200, Municipal Council Chambers

351 West Center, Provo, Utah

Summary of Action

Decorum

The Council requests that citizens help maintain the decorum of the meeting by turning off electronic devices, being respectful to the Council and others, and refraining from applauding during the proceedings of the meeting.

Opening Ceremony

Roll Call

Invocation and Pledge

Approval of Minutes

Presentations, Proclamations and Awards

1.

- A presentation by the Covey Center

- Employee of the Month for the month of May, 2016 - Chad Roscher

- Miss Provo and Royalty presentation

Public Comment

- A public hearing on an ordinance adopting a tentative budget for Provo City Corporation for the Fiscal Year beginning July 1, 2016 and ending June 30, 2017, in the amount of $201,794,044, setting a public hearing to consider a proposed change in the Certified Tax Rate, and amending the Consolidated Fee Schedule and Provo City Code Section 4.04.060. (16-054)

Approved the ordinance with no tax increase 5:2. Council Member Gary Winterton and David Harding opposed.

I saved this description for last, as it will be the hardest to write. I have a separate, multi-page blog draft that I've been working on for more than a week. In that post I'm struggling with the balance between being concise, and being detailed enough to catch the nuances. But in this post I'll definitely err on the side of brevity. The one line report-of-action doesn't come close to capturing the wrestle that occurred before the final vote. I advocated hard to follow through with our Budget Intent Statement, reaffirmed just 5 days before, to adjust our property tax rate to account for inflation. (I'll skip the details, but should at least note that even with the adjustment, the property tax rate that we would have paid would still be less than the rate we paid last year, see here for an explaination). The majority of the Council were not willing to follow through with our stated intent. Councilor Sewell proposed a revenue-neutral plan that would see the inflation adjustment happen, but would offset it with a reduction in the utility rate increases for next year, and then would offset the reduction in utility rate revenue by directing the increased property tax revenue to the utilities. It was a bit of a shell game, but it would have allowed us to follow through with our intent, and would have helped establish a precedent and a practice of routinely considering property tax inflation adjustments through the truth-in-taxation process, without actually increasing the burden on residents over the proposal to not adjust the property tax rate.

So that explains what happened. My forthcoming blog post will explain more of the "why" I was advocating for the adjustment, but I feel I should touch on it a little bit here. Sales tax is collected at a fixed rate, it stays the same unless legislative action is taken to adjust it. A candy bar might cost $0.05 fifty years ago and $0.50 today, so the sales tax on the same item will go up with inflation, even though the rate may stay the same. But inflation also affects the cost of the services we provide, so the $0.03 collected on the candy bar today will pay for about the same amount of services that the $0.003 collected on the candy bar 50 years ago. Property tax rates do NOT work in the same way. The property tax rate is automatically adjusted to compensate for appreciation (which is affected by inflation). The rate decreases (assuming there is some appreciation) unless legislative action is taken to adjust it. The way it is set up, the same number of dollars you paid on your house that was worth $100k 25 years ago is the same number of dollars you pay for the same house, even though it is now work $200k, assuming that your home experience average appreciation, and that no legislative action was taken to adjust the rates during that period. Clearly a dollar today has less buying power than a dollar 25 years ago. Clearly inflation would have eroded the value of the property taxes collected during over that time. As crazy as that scenario sounds, that is pretty much what has happened in Provo. We have had a single inflation adjustment (2.2% last year) to our property tax rate in the last 25 years. The buying power of our property taxes have eroded significantly over that period.

Taxes aren't enjoyable, but help pay for our services. Low taxes are great, as long as we are sustainably funding the services that our residents want. I'm fine with cutting services and reducing taxes, if that is what the residents want. I'm fine with providing more services and raising taxes, if that is what the residents want (and recent ballot measures like the Rec Center and RAP suggest this). What I'm not okay with is not appropriately paying for the services that we use, basically living off the investment of previous generations without making our own contribution, or pushing off to the next generation the payment of the services we use now. I believe we have been irresponsible over the past quarter century where we have not raised property taxes or utility rates. I applaud the former Council for creating a plan to put us on a path to sustainable utilities and the current Council for continuing to implement that painful but necessary plan. I am disappointed with the current Council for not having the political will to even begin to address the parallel issue with property taxes. We've dug a hole for ourselves over 25 years. This year we considered a budget that would not have started the climb out of the hole, but would have at least stopped us from digging deeper. It would have cost the average household $0.15 a month, or $1.80 a year. To me that is a small price to pay for fiscal responsibility. You can decide for yourself if paying for what you use is a principle that you think our community should live by.

[Imagine if I wasn't trying to be brief!]

P.S. I should also mention that I moved to take out the $10k increased funding for the Miss Provo Scholarship Pageant. I don't question whether these young women are talented, or if they are an asset to our community. I just question if it is in the best interest of our community to spend tax money on their scholarships and program expenses. My motion failed to gain sufficient support.

- A resolution authorizing Provo City to enter into an Interlocal Agreement with the Redevelopment Agency of Provo authorizing the use of tax increment to facilitate the development of Cityview Apartments. (16-081)

Approved 7:0.

I wrote a fairly extensive preview on this issue (items 5 and 7) in the last "What's Up?". I made the case for reducing the Tax Increment Financing (TIF) on this project from 95% down to 90%, as a signal to the development community that Downtown Provo is on its way to being able to stand on its own two feet and we will be easing off on the incentives. It should be noted that the 5% change would amount to roughly $13k on a $20+ million dollar project, and that the other taxing agencies (like Provo School District and Utah County) are participating in the low to mid 70% range. The sentiment on the Council was that we shouldn't make this change at the last minute on this project, but should consider reducing the TIF on future projects. As the Vice-Chair of the RDA board this is the fourth time I've met with the applicant about this project and every time I explained that I would be exploring the wisdom of reducing TIF rate, so I disagreed that this was last minute.

- A public hearing on a resolution adopting a budget for the Redevelopment Agency of Provo City Corporation for the Fiscal Year beginning July 1, 2016 and ending June 30, 2017, in the amount of $4,292,168. (16-055)

Approved 7:0.

The RDA portion of the budget.

- A resolution authorizing the Redevelopment Agency of Provo City to execute an Interlocal Agreement with Provo City, Provo School District, Utah County, and the Utah Water Conservancy District authorizing the collection of tax increment related to facilitate the development of the Cityview Apartments. (16-082)

Approved 7:0.

Related to item 5.

- A public hearing on a resolution adopting a budget for the Provo City Storm Water Special Service District in the amount of $4,196,915 for the Fiscal Year beginning July 1, 2016 and ending June 30, 2017. (16-056)

Approved 7:0.

The Storm Water portion of the budget.

- A resolution authorizing the Mayor to approve an application for a Byrne Justice Assistance Grant and to execute an Interlocal Cooperation Agreement with Utah County relating to the 2016 Byrne Justice Assistance Grant Program. (16-079)

Approved 7:0.

From the last "What's Up?": From the support documents: "Provo City has been awarded $23,500 from the Bureau of Justice Administration (BJA) for law enforcement purposes. The Police Department will be using the funds to purchase tazers (CEW's) and to help fund their computer replacement program. The BJA requires submittal of a resolution approving the grant and an interlocal agreement with Utah County before funds will be released."

No comments:

Post a Comment